Увлечение 179 start.me

Section 179 deduction dollar limits. For tax years beginning in 2024, the maximum section 179 expense deduction is $1,220,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $3,050,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2024 is $30,500.

LX11BGVIlfordP1630925 LX11 BGV on route 179 during the s… Flickr

Sale Price = 179.95 - 53.99. Sale Price = $125.97 (answer). This means the cost of the item to you is $125.97. You will pay $125.97 for an item with an original price of $179.95 when discounted 30%. In this example, if you buy an item at $179.95 with 30% discount, you will pay 179.95 - 54 = 125.97 dollars.

One Piece Chapter 179 TCB Scans

Discount = 179 × 30 / 100. Discount = 179 x 0.3. You save = $53.70. Final Price = Original Price - Discount. Final Price = 179 - 53.7. Final Price = $125.30. How to calculate 30 percent-off $179. How to figure out percentages off a price. Using this calculator you will find that the amount after the discount is $125.3.

twin

Nerdy takeaways. A Section 179 expense is a business asset that can be written off for tax purposes right away rather than being depreciated over time. In 2023 (taxes filed in 2024), the maximum.

30 Off Phone Bill ( Daily Deal Roundup 2/23/2022) —

All work and steps for the 30 % off of 179 amount.

179..jpg

Replacing the given values in formula (a) we have: Amount Saved = Original Price x Discount in Percent / 100. So, Amount Saved = 179.99 x 30 / 100. Amount Saved = 5399.7 / 100. Amount Saved = $54 (answer). In other words, a 30% discount for an item with an original price of $179.99 is equal to $54 (Amount Saved).

Видео 179 YouTube

Discount = 179 × 30 / 100. Discount = 179 x 0.3. You save = $53.70. Final Price = Original Price - Discount. Final Price = 179 - 53.7. Final Price = $125.30. How to calculate 30 % off $179. How to figure out percentages off a price. Using this calculator you will find that the amount after the discount is $125.3.

179

179.98. 53.99. 179.99. 54.00. What is 30 percent of 179? How much is 30% of 179? What is three tenths (3/10) of 179? Use this easy and mobile-friendly calculator to calculate 30 percent of 179, or any other percentage.

179DC On/Off MagnaValve Electronics Inc

What is 30 Percent off 179?, 30% off 179 - Discount Calculator. Discount Calculator. Discount Calculator. Percentage Calculator. Discount Calculator is a free online tool to calculate discount of products. Original Price: Discount Percentage % (Percent) : What is ____ % Percent off ____?

2020 Tax Code 179 For Business Owners & The SelfEmployed

Percent off: reduced price = original price - (discount percentage * original price / 100) Fixed amount off: discount percentage =100 - (100 * (original price - fixed amount off) / original price). If a customer buys products in your store for 30 euros, the customer will receive a loyalty point on his or her card. If the same customer has a.

FileKABAR.jpg Wikipedia, the free encyclopedia

Just type in any box and the result will be calculated automatically. Calculator 1: Calculate the percentage of a number. For example: 30% of 179 = 53.700000000000003. Calculator 2: Calculate a percentage based on 2 numbers. For example: 53.700000000000003/179 = 30%.

This Jeopardy! Sports Category Goes Entirely off the Rails for These

Enter the original price into our percent off calculator. For example, a TV set might originally set you back $5000. Determine the percentage discount - in our example store, everything is 75% off. The sum that stays in your pocket - your savings - is simply these two values multiplied by each other: 75% × $5000 = 0.75 × $5000 = $3750.

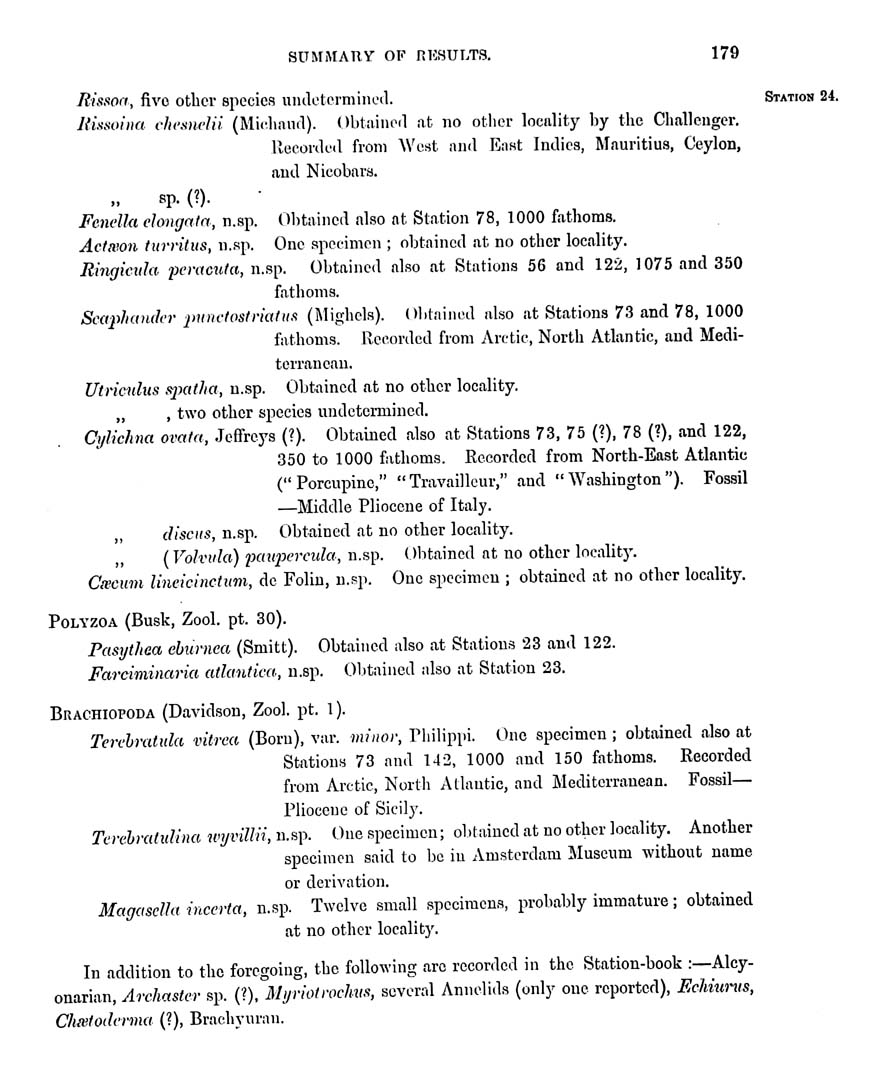

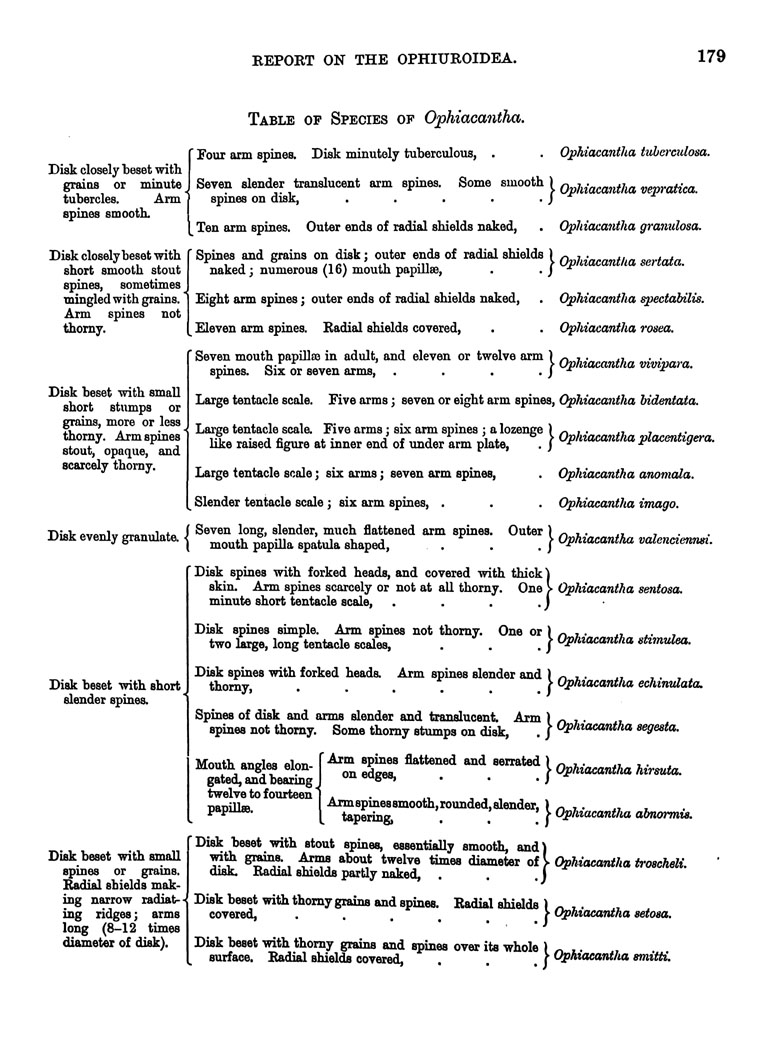

page 179

A company cannot take a Section 179 deduction on more than their total annual taxable income. For example, if a company reports $100,000 as their net income, they can only claim $100,000 for Section 179, however, any qualifying amounts beyond the limit can be carried forward to future years. For tax year 2023, companies can deduct no more than.

SA 179 Tasche

Section 179 Deduction allowances are very helpful for small and medium-sized companies. Many will get significant savings from using this method. However, there are Dollar deduction limits for companies. In 2022, the spending cap on equipment purchases is $2,700,000 to be eligible for Section 179.

page 179

A percent off of a product or service is a common discount format. A percent off of a product means that the price of the product is reduced by that percent. For example, given a product that costs $279, 20% off of that product would mean subtracting 20% of the original price from the original price. For example: 20% of $279 = 0.20 × 279 = $55.80

Luminaire Vali80 179500W10GGE/940, W Halla, a.s.

30% off 170 Calculation Explanation. In order to calculate 30% off 170 let's first find the discount: Discount = (170 × 30) ÷ 100. =. 5100 ÷ 100. =. 51. Subtract the discount from the initial price to get the discounted price: Discounted Price = 170 - 51.