Alabama Utility Contractors Association Birmingham AL

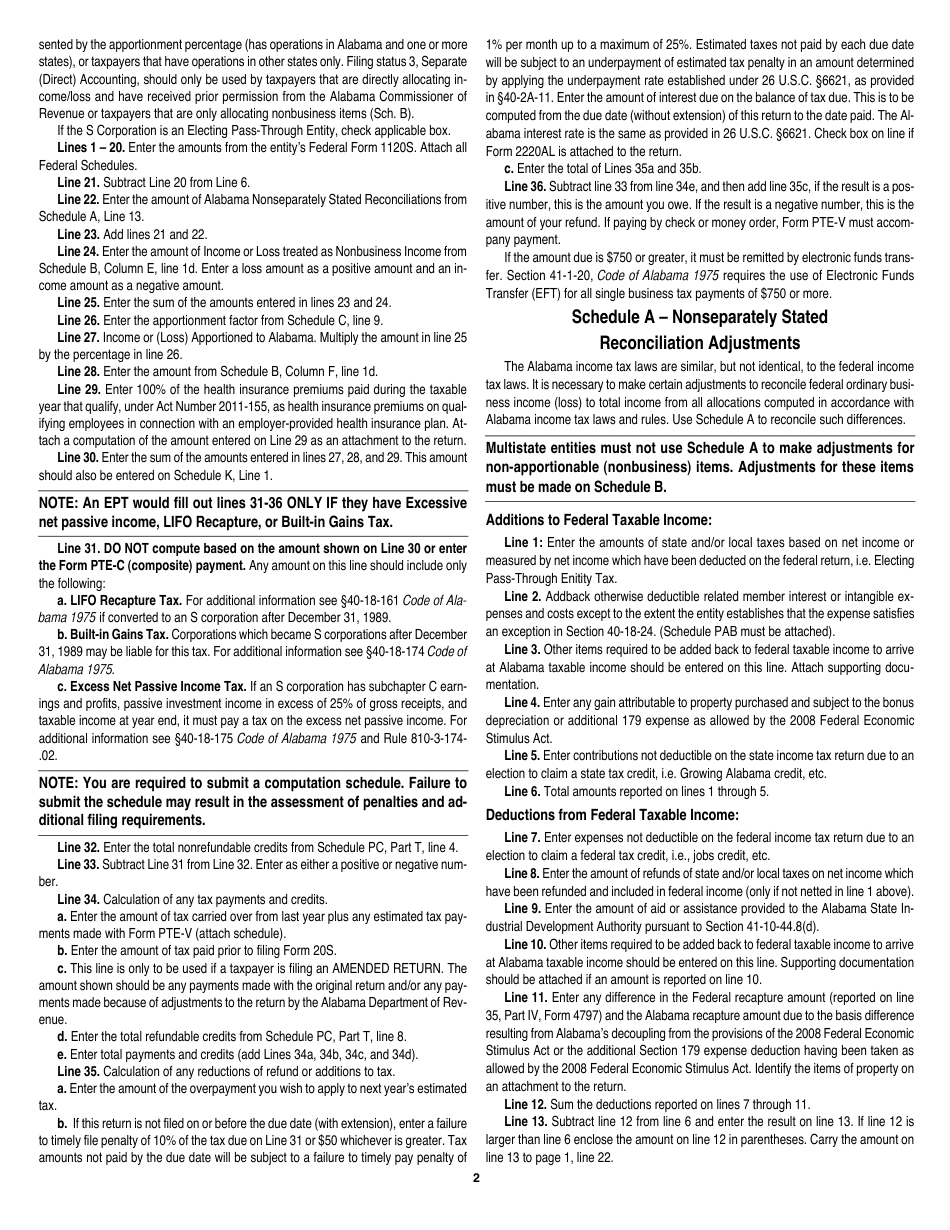

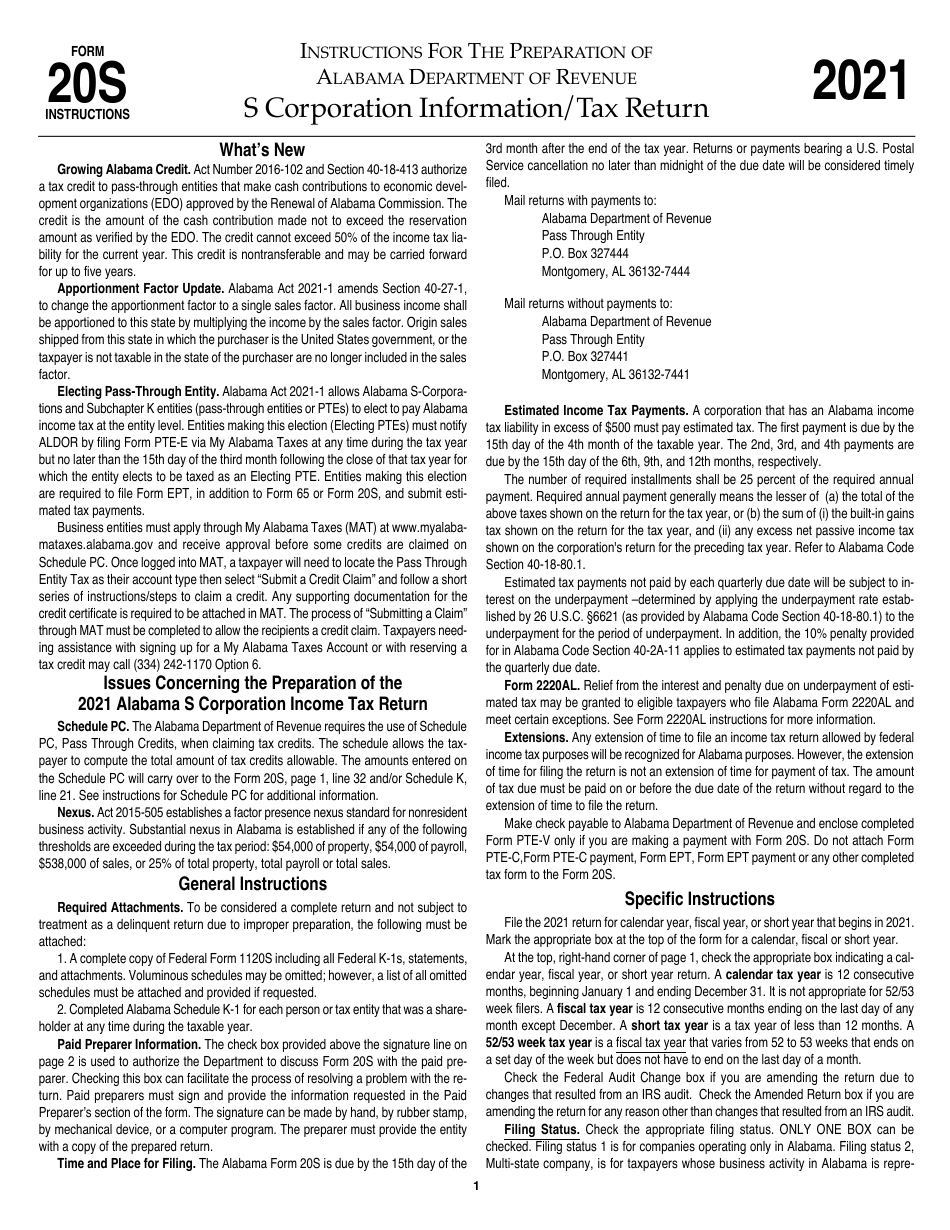

Form 20S (65) Schedule PC Pass-Through Credits - Alabama. This document contains official instructions for Form 20S, S Corporation Information/Tax Return - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form 20S (65) Schedule PC is available for download through this link.

Download Instructions for Form 20S S Corporation Information/Tax Return

FORM 20S - 2020 Page 3 SCHEDULE C - Apportionment Factor Schedule. Do not complete if entity operates exclusively in Alabama. SCHEDULE D - Apportionment of Federal Income Tax ("FIT") (LIFO Recapture Tax Only) SCHEDULE E - Alabama Accumulated Adjustments Account 15.

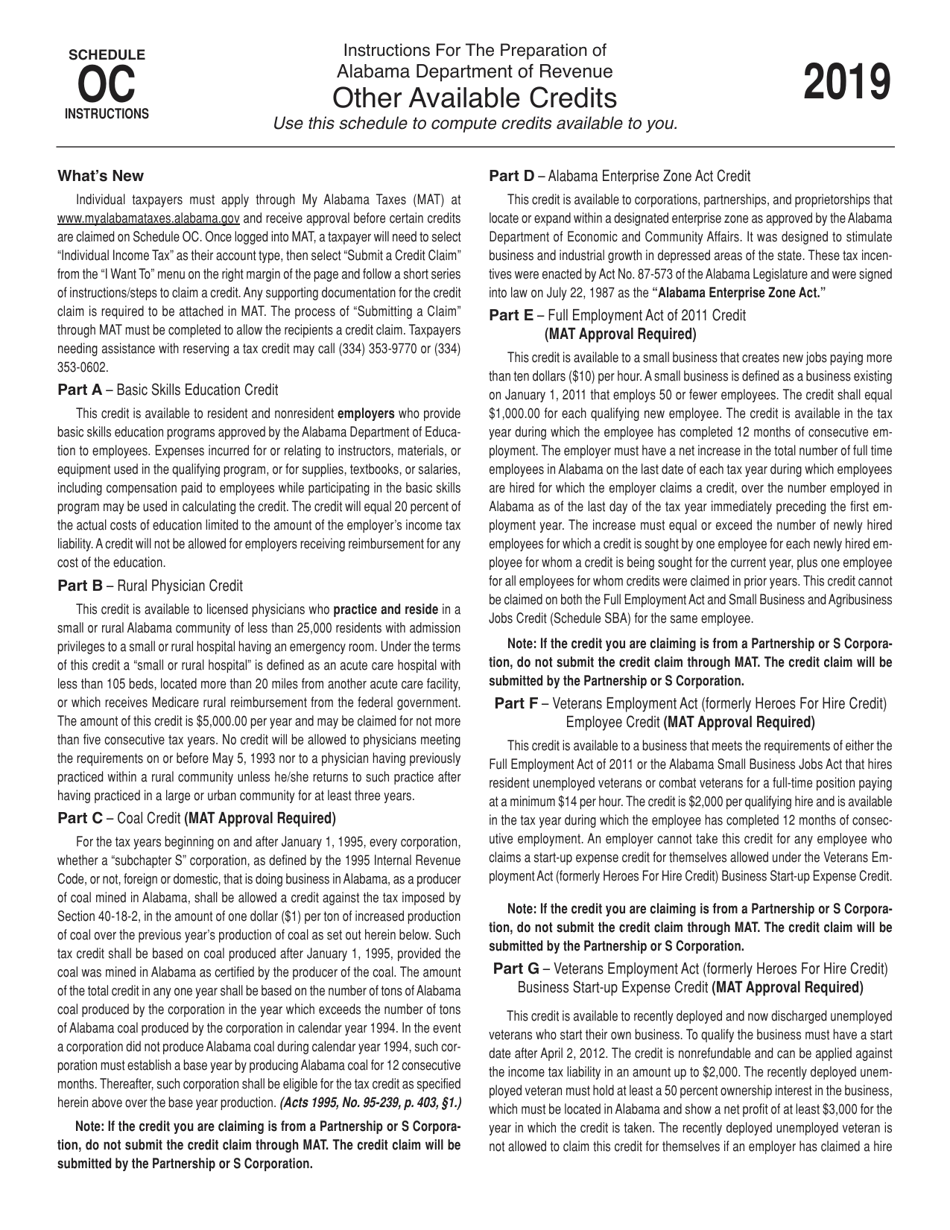

Download Instructions for Schedule OC Other Available Credits PDF, 2019

The Alabama Department of Revenue's website (www.revenue.alabama.gov) has available Alabama S corporation tax laws, regulations, forms and instructions. Line 1. Enter the ordinary business income (loss) from page 1 of the fed-eral Form 1120S, U.S. Income Tax Return for an S corporation. Attach a copy of the complete federal Form 1120S.

Alabama form 40 instructions 2022 Fill out & sign online DocHub

Form PTE-V only if you are making a payment with Form 20S. Do not attach Form. PTE-C,Form PTE-C payment, Form EPT, Form EPT payment or any other completed tax form to the Form 20S. Specific Instructions. File the 2022 return for calendar year, fiscal year, or short year that begins in 2022. Mark the appropriate box at the top of the form for a.

2021 Form AL DoR 40NR Fill Online, Printable, Fillable, Blank pdfFiller

FORM PTE-C SCHEDULE PTE-CK1 INSTRUCTIONS 2021. General Instructions Original Due Date The calendar year return is due on or before March 15, 2022. For fiscal year. Section 41-1-20, Code of Alabama 1975requires all single tax payments of $750 or more to be made electronically. My Alabama Taxes (MAT) is a secure

State of Alabama Client Assistance Program Montgomery AL

FORM 20S - 2021 Page 4 SCHEDULE G - Other Information 1. Briefly describe your Alabama operations: • 2. Location of the corporate records: • 3. If the privilege tax return was filed using a different FEIN, please provide the name and FEIN used to file the return: FEIN: • NAME: 4.

Alabama State University Department of Social Work

Alabama Act 2021-1 allows Alabama S-Corporations and Subchapter K entities (pass-. tion are required to file Form EPT, in addition to Form 65 or Form 20S, and submit estimated tax payments.. Specific Instructions File the 2021 return for calendar year, fiscal year, or short year that begins in 2021. At the top, right-hand corner of page 1.

Alabama Crimson Tide Shirt of the Month Club

*2200042S* FORM 20S - 2022 Page . 4. SCHEDULE G - Other Information. Briefly describe your Alabama operations: 1. • 2. Location of the corporate records: •

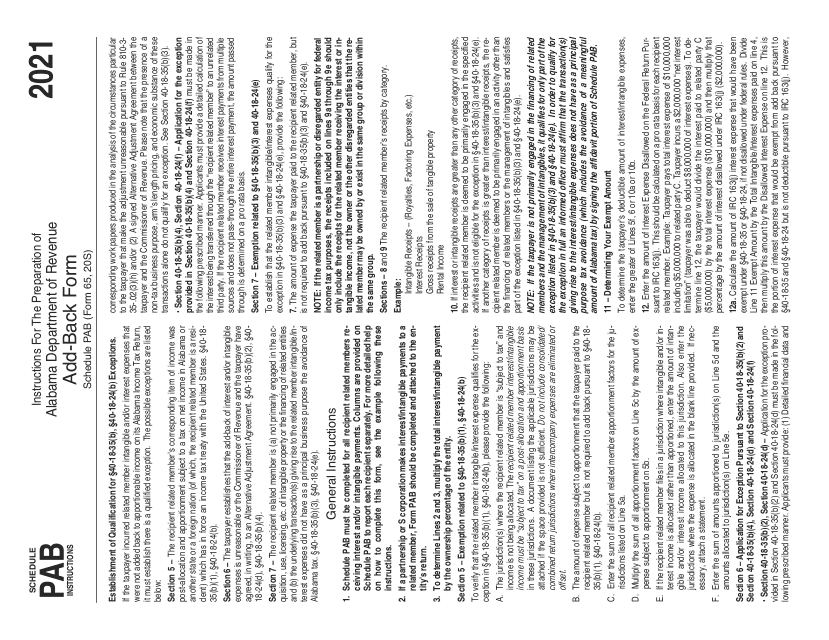

Download Instructions for Form 65, 20S Schedule PAB AddBack Form PDF

Amended K-1. PART I. Information About the Pass Through Entity. PART III. Owner's/Shareholder's Share of Current Year. Alabama Income, Deductions, Credit, and Other Items. A. Entity's Federal Employer Identification Number. Income allocated and apportioned.

Alabama Entry Form Fill Out, Sign Online and Download PDF

ALL. BF-1. Application to Become a Bulk Filer. ALL. Form 6014-A. Authorization for Access to Third Party Records by Alabama Department of Revenue Employees. ALL. B&L-PR. B & L Petition for Review of Preliminary Assessment.

.png)

C Wallace (Alabama Governor).png Wikimedia Commons

ALDOR has released updated pass-through and fiduciary instructions: Form 20S Instructions ; Form 20S ; Form 41 Instructions ; Form 41 ; Form 65 Instructions ; Form 65 ; 11/4/2022. Back To List. Events & CPE Catalog. Alabama Society of CPAs. 1041 Longfield Court Montgomery, AL 36117 (800) 227-1711. Connect. Member Publications; Chapters; Young.

Download Instructions for Form 20S S Corporation Information/Tax Return

Alabama Corporation Income Tax Return Form 20C *2300012C* FORM 20C •CY •FY •SY •52/53 WK Alabama Department of Revenue Reset Form Corporation Income Tax Return 2023 For the year January 1 - December 31, 2023, or other tax year beginning •_____, 2023, ending •_____, _____ Check applicable box: • PL 86-272 Initial • return Final • return • Amended return Federal • audit.

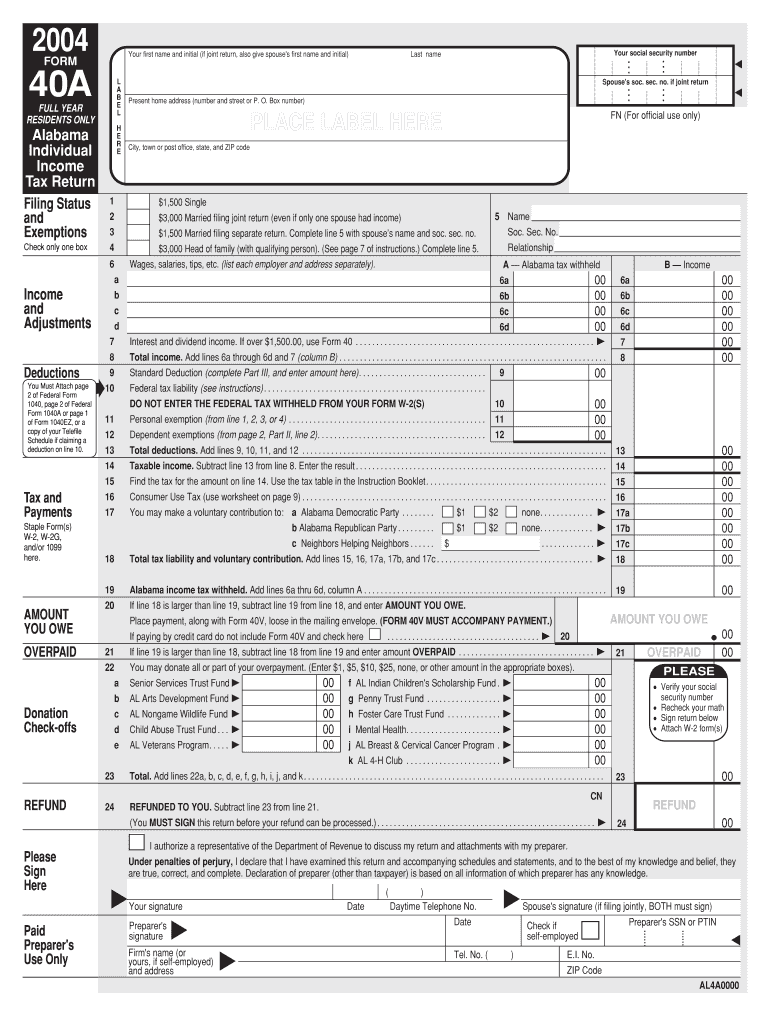

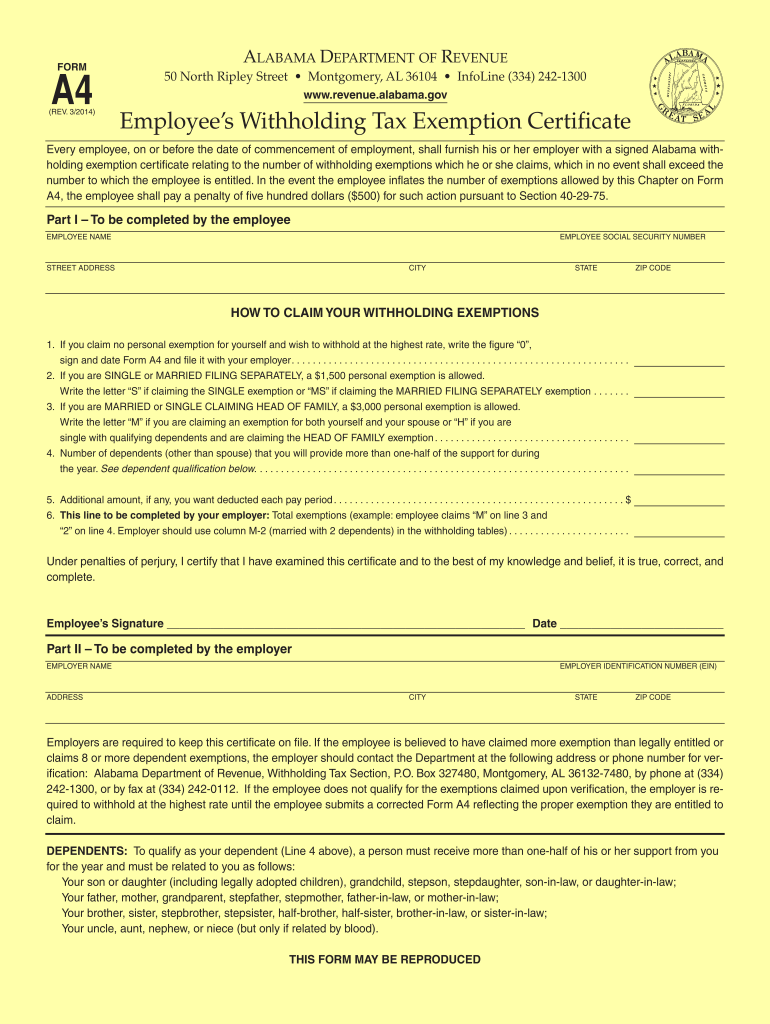

20142021 Form AL DoR A4 Fill Online, Printable, Fillable, Blank

On February 12, 2021, Governor Kay Ivey signed into law HB 170 and HB 192.HB 170 makes changes to Alabama's corporate income tax law, exempts certain COVID-19-related payments from state income and financial institution excise taxes and establishes a new elective passthrough-entity-level tax intended to enable Alabama taxpayers to deduct their business taxes for federal income tax purposes.

_1904.jpg)

FileUSS Alabama (BB8) 1904.jpg Wikimedia Commons

The 2021 Form 2210AL should be submitted with the 2021 individual income tax return. FAQ. Follow the instructions to make the election.. of Title 40, Code of Alabama 1975. Use the total of total of lines 1 through 17 in the Alabama column on Schedule K, Form 65, or Form 20S, to determine Alabama taxable income. Alabama tax paid under this.

Alabama form 40a instructions Fill out & sign online DocHub

The Alabama Form 20S is due by the 15th day of the. 2021. 3rd month after the end of the tax year. Returns or payments bearing a U.S. Postal Service cancellation no later than midnight of the due date will be considered timely filed. Mail returns with payments to: Alabama Department of Revenue Pass Through Entity.

Alabama Democratic Party lgbtq+ Caucus

ALABAMA 20C-C - 2021 *210002CC* SCHEDULE B - Alabama Consolidated Net Operating Loss Carryforward Calculation (§§40-18-35.1 and 40-18-39h) SCHEDULE AS - Affiliations Schedule Alabama consolidated net operating loss (enter here and on line 1a, page 1). ADOR COLUMN 1 Loss Year End MM / DD / YYYY COLUMN 2 Amount of Alabama net operating.