NZ GST Return

GST Calculator NZ Add & Subtract GST Automatically Calculate GST with Including Amount Calculate GST with Excluding Amount Calculate GST with Your Tax Amount Enter Amount Select GST Country Enter Amount $ Enter GST Rate % Select Decimal Point Copy (Add GST) Net Amount $ GST Rate 15% GST Rate Amount 0.00 $ Gross Amount 0.00 $ (Subtract GST)

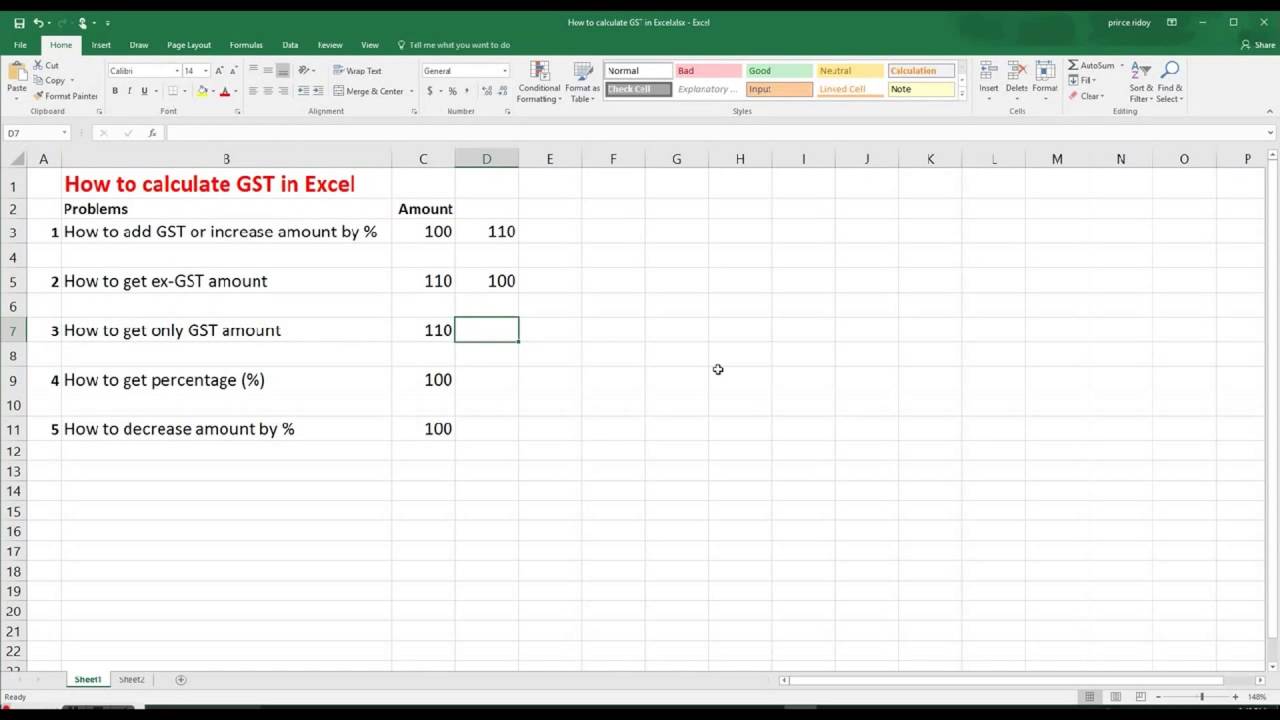

How to calculate gst in excel learningaceto

GST Calculator | Afirmo NZ How to calculate GST for Small Businesses GST, aka goods and services tax, is collected on most goods and services sold in New Zealand. It's included in the price paid and collected by the seller, then paid to Inland Revenue. The amount of GST charged and collected is 15% of the non-GST price.

GST Calculator (New Zealand) Apps on Google Play

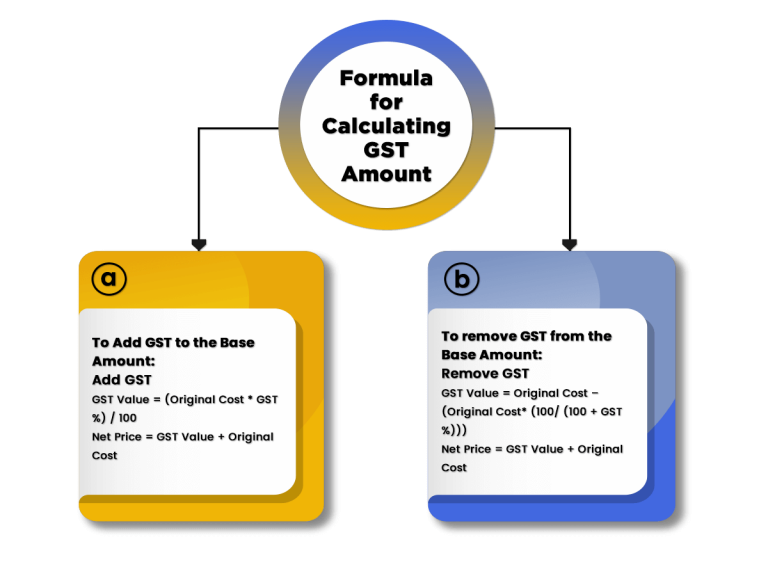

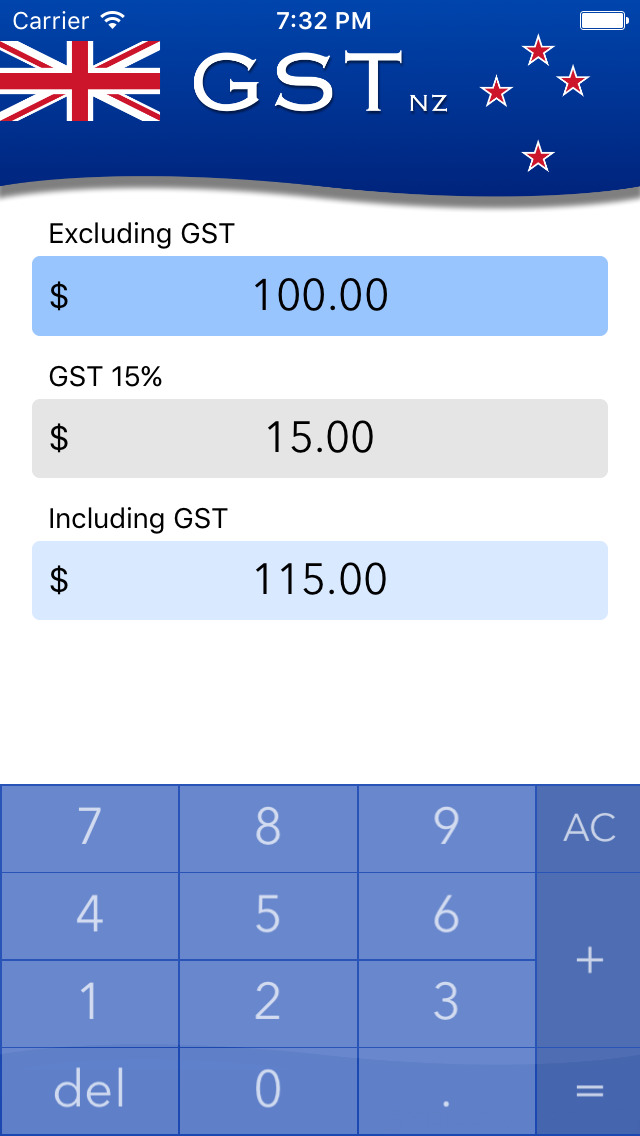

The formula for calculating GST in New Zealand involves multiplying the net amount by 15%. This means that if you have a product with a cost before taxes of $100, then adding GST would mean the final cost would be $115. To subtract GST, simply divide the gross amount by 1.15 to find out what it was before tax was applied.

Online GST Calculator Easiest Way to Calculate GST Amount

For calculating New Zealand 15% GST (Goods and Services Tax) Use our all in one GST calculator to find GST inclusive and exclusive prices, or the correct GST content of a product or service. GST Exclusive Price Add GST GST Inclusive Price Get GST GST Content Get Prices Clear

How to Calculate GST and Issue Tax Invoices GST Guide Xero NZ

Here are the general steps for calculating GST in New Zealand: Determine the GST rate - The current GST rate in New Zealand is 15%. Determine the total purchase amount - This is the amount paid for the goods or services, including any taxes or fees. Calculate the GST - To calculate GST, multiply the total purchase amount by the GST rate.

GST Calculator NZ, GST 15 Accounting 4 Me

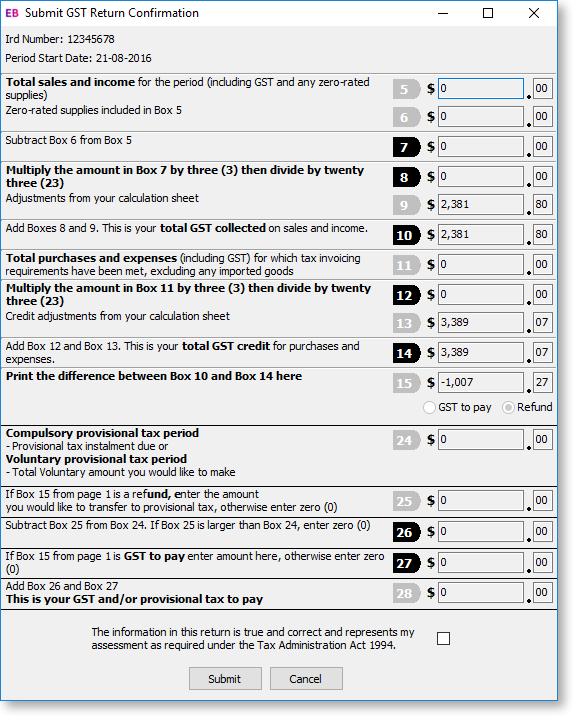

Te tātai i tō tāke hokohoko Calculating your GST Most people file their GST return in myIR which does the calculations for you. If you file a paper return the form tells you what calculations to make. Regardless of how you file you need to work out your total: sales and income zero-rated supplies debit adjustments purchases and expenses

NZ GST Calculator

GST Calculator This Goods and Services Tax calculator will help you calculate GST with one simple step. By entering a value into the "Enter Amount" box the GST calculation tool will automatically update with the relevant figures for the pre-GST and post GST calculations.

Calculating Goods and Services Tax (GST) in New Zealand YouTube

How do I calculate GST? When do I need to register for GST? Can I change the GST rate? Does the calculator still support calculations via the url? Calculate New Zealand GST (15%), inclusive, exclusive, added, subtracted, before, after GST with this easy to use visual calculator.

Download do APK de GST Calculator for New Zealand para Android

Calculate GST in NZ GST Rate % Price excluding tax $ GST (15%) $ PST (7%) $ Price including tax $ Clear Powered by Gstinfo.net Welcome to our online New Zealand GST calculator. Our user-friendly interface allows you to easily calculate GST amounts for your business transactions.

How to Correctly Calculate GST Figures Kiwitax

To calculate New Zealand GST at 15% rate is very easy: just multiple your GST exclusive amount by 0.15. $300 is GST exclusive value $300 * 0.15 = $45 GST amount To get GST inclusive amount multiply GST exclusive value by 1.15 $300 is GST exclusive value $300 * 1.15 = $345 GST inclusive amount

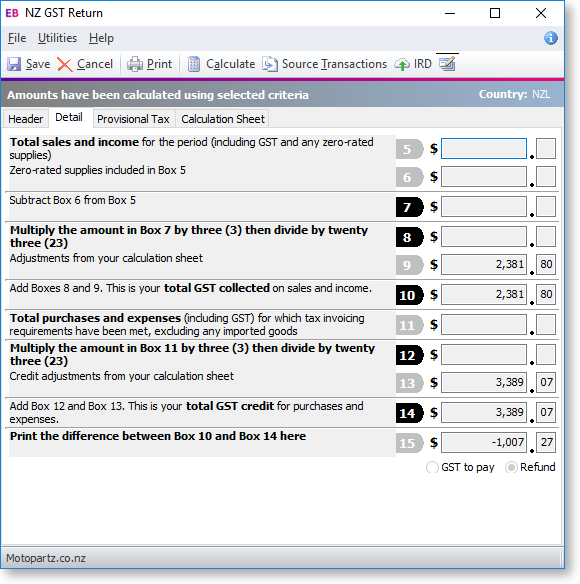

NZ GST Return

From expenses to tax returns and more, you'll discover the effortless way to stay on top of it all. Try Solo free. New Zealand self-employed GST calculator. Automatically calculate NZ GST and GST returns - as you go. Take the guesswork out of GST.

Features & Benefits

New Zealand GST calculator. Calculation is based on current GST rate 15% . Type in your amount in NZ$ in the text field. No buttons required. GST excluded amount:. TOTAL with GST: Calculating GST for Australia? Check out our Australia GST calculator. Other tools: Rental Yeald Calculator Nicotine Calculator Plymouth, UK — tide times Torquay.

GST NZ Calculate New Zealand GST by Kelly Rodgers

New Zealand's BEST GST Calculator - so simple to use on your computer or mobile. Calculate inclusive and exlcusive GST amounts now. Add or Subtract GST with precision.

GST NZ Calculate New Zealand GST by Kelly Rodgers

GST Calculator NZ: Effortlessly Determine Goods and Services Tax with Our Comprehensive Tool. The Goods and Services Tax (GST) is a value-added tax that is applied to most goods and services in New Zealand. The current rate of GST is 15%, and it is added to the price of goods and services at the point of sale. As a business owner or individual.

Understanding the Zero Rate GST in New Zealand

The formula for calculating the total amount of GST paid on a sale is as follows: Sale Price (including GST) x [GST Rate] = Total Amount of GST Charged. For example, if an item was sold at $100 including GST, applying this formula would result in $15 being charged as GST ($100 x 0.15 = $15).

AU & NZ GST Calculator

The mathematics behind calculating GST in NZ Basic GST Calculations. Adding GST Goods and Services Tax in NZ is 15% To add 15% GST on $100 $100 x 15% = $15 GST $100 + $15 GST = $115 GST Inclusive. A quick way to Add GST is to Multiply the GST exclusive amount by 1.15 Examples Below: $200 + GST = $200 x 1.15 = $230 $500 + GST = $500 x 1.15 = $575