An Overview of Triple Candlestick Patterns Forex Training Group

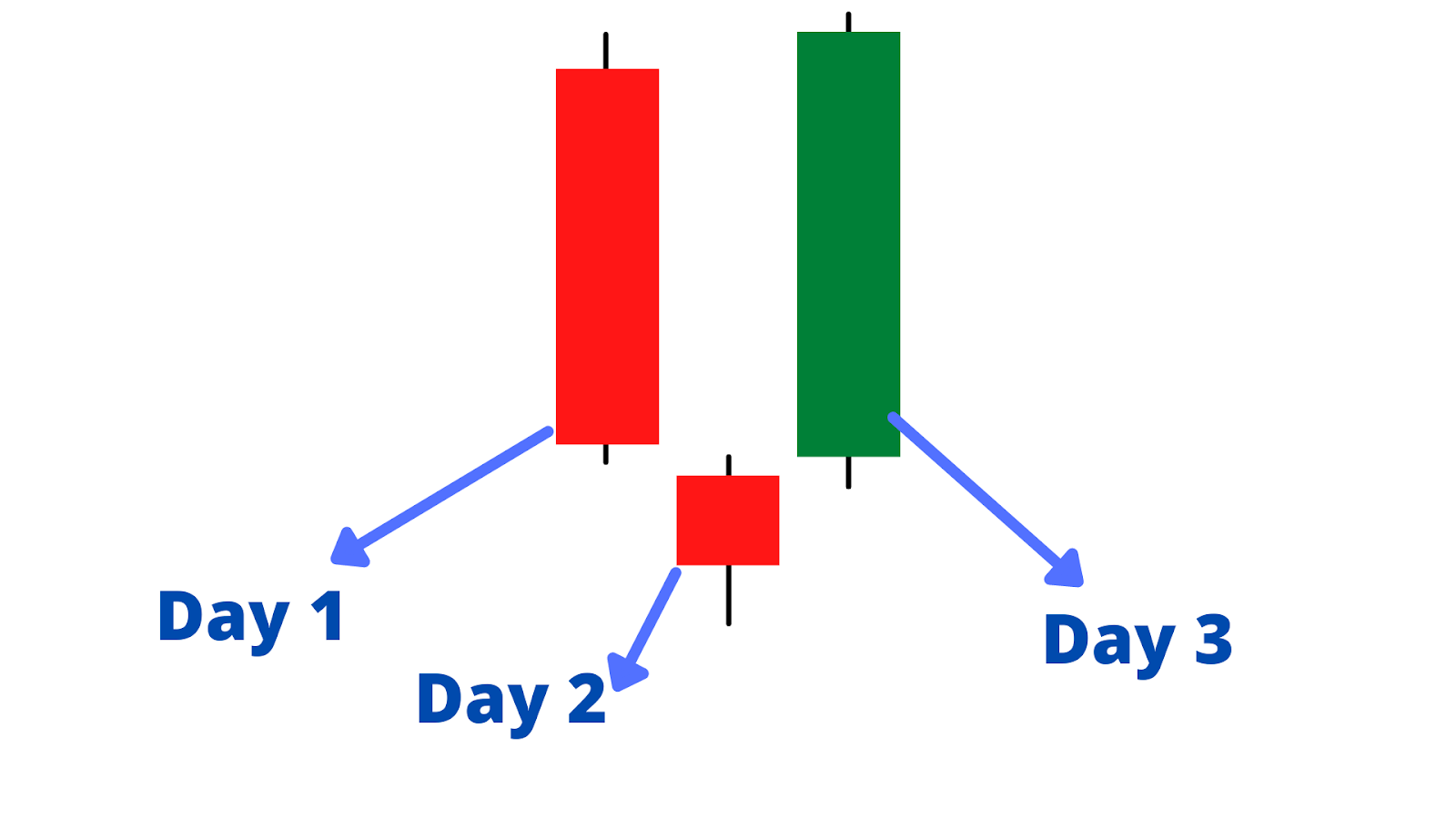

What is a Morning Star Pattern? The morning star is a bullish reversal candlestick pattern that appears at the bottom of a trend or end of a bullish continuation pattern. The Morning star has three candles. The first candle is a large red candle, the second candle is small (known as the star), and the third candle is a large bullish candlestick.

Morning Star Pattern A Guide to Trading This Bullish Reversal Pattern

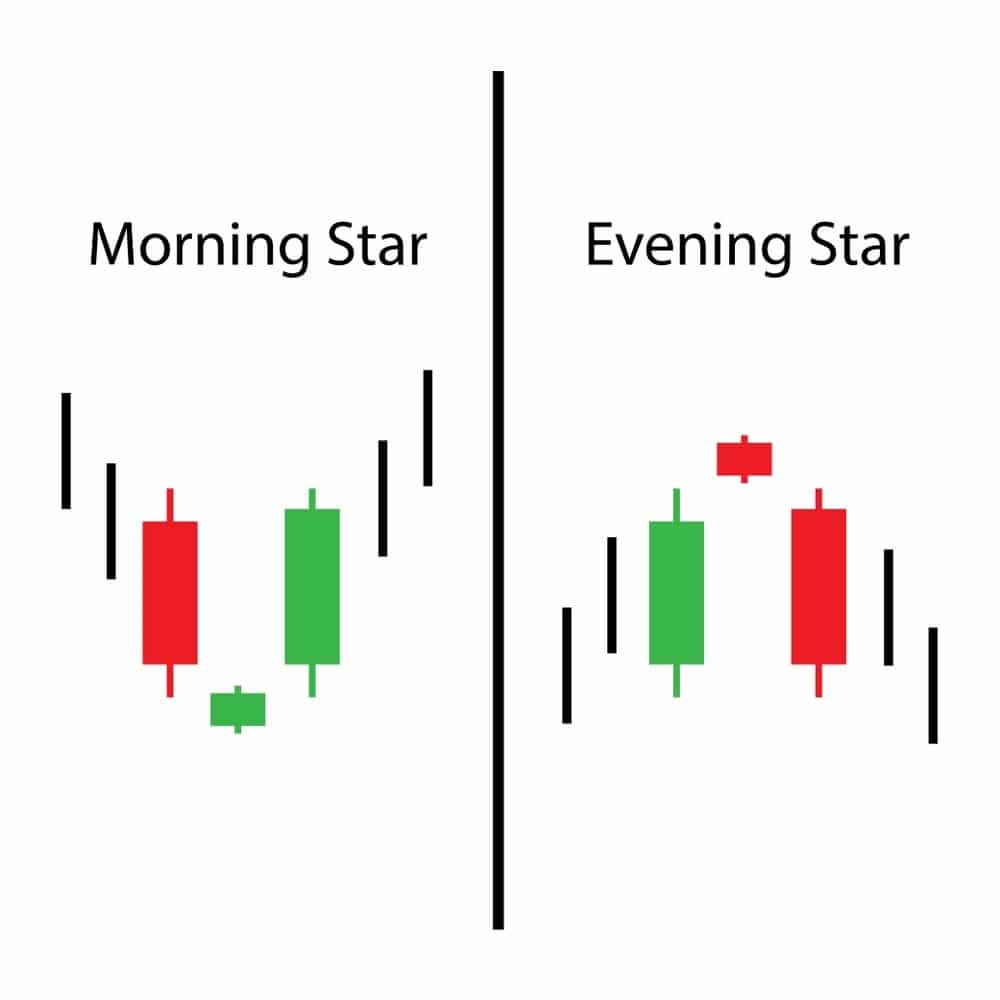

A morning star is a three candle reversal candlestick pattern that forms after a downtrend. The first candle is bearish and followed by a doji that gaps down. The third candle gaps up and finishes as a big, positive candle. In this article, we're going to have a closer look at the morning star candlestick pattern.

Morning Star Pattern How to Identify a Bullish Reversal in Crypto

The morning star pattern, pivotal in technical analysis, signals an imminent bullish reversal during a downtrend. It symbolizes not just price changes but a psychological shift in the market. This pattern indicates a decline in bearish control and a rise in bullish influence, offering key insights for traders in the fluctuating stock market.

Morning Star Candlestick Pattern

The morning star pattern is one of the easiest patterns to understand and implement. It indicates clear entry points so it can be easily used by new and seasoned traders. Apart from technical analysis, traders should not forget to undertake a thorough fundamental analysis to select the target stocks or sectors.

How To Trade Blog What Is Morning Star Candlestick Pattern? How To Use

What Is a Morning Star Pattern? A morning star pattern consists of three candlesticks that form near support levels. The 1st candle is bearish, the 2nd is a spinning top or doji, and the 3rd is a bullish candlestick. Typically, the 3rd candle forms a bullish reversal pattern. These patterns are made up of three candlesticks.

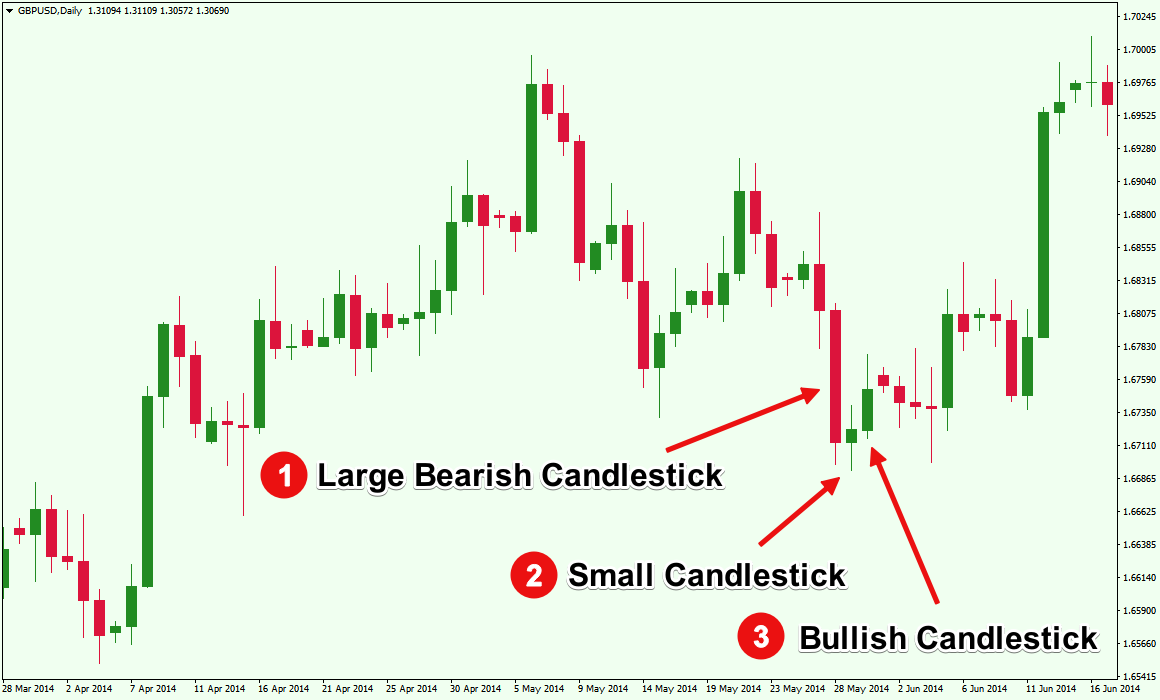

A Tutorial On The Morning Star Candlestick Pattern Forex Training Group

Morningstar assigns star ratings based on an analyst's estimate of a stock's fair value. Four components drive the Star Rating: (1) our assessment of the firm's economic moat, (2) our estimate.

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What is the morning star pattern? The morning star pattern is a series of three candlesticks on a market's chart that indicate an upcoming bullish reversal. If a technical trader sees a morning star appear after a downtrend, they take it as a sign that selling sentiment may be losing ground to buyers. A morning star forms over three periods.

Morning Star Candlestick Pattern How To Trade and Win Forex With It

Morning star patterns are bearish to bullish reversal patterns. Therefore, only buy positions should be opened. On the other hand, if a sell position is being held and this pattern forms, profits will be taken since a possible reversal is imminent. Three market sessions make up this pattern. Ideally, a gradual introduction of bullish momentum.

Morning Star Forex Pattern Forex Education

The morning star candlestick pattern is a common bullish pattern used by price action traders. It is a pattern in a similar class to the other formations like doji, hanging man, hammer, and evening star that we have looked at before. In this report, we will look at what it is and how you can use it in the financial market. Contents

What Is Morning Star Candlestick Pattern? How To Use In Trading How

The Morning Star [1] is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Description [ edit]

Morning Star Candle Stick Pattern

Morning Star Candlestick Pattern | How to Identify Perfect Morning Star Pattern - YouTube © 2023 Google LLC The Morning Star Candlestick Pattern is a bullish reversal candlestick.

Morning Star Candlestick Pattern How To Trade and Win Forex With It

The Morning Star Pattern is viewed as a bullish reversal pattern, usually occurring at the bottom of a downtrend. The pattern consists of three candlesticks: Large Bearish Candle (Day 1) Small Bullish or Bearish Candle (Day 2) Large Bullish Candle (Day 3) The first part of a Morning Star reversal pattern is a large bearish red candle.

Morning Star Candlestick Pattern Trading Rules Market Pulse

The Morning Star is a candlestick pattern that is comprised of three candles. A completed Morning Star formation indicates a new bullish sentiment in the market. It is considered a reversal pattern that calls for a price increase following a sustained downward trend. The Morning Star candlestick structure starts off with a relatively long red.

Morning Star Candlestick Pattern Trendy Stock Charts

The Morning Star candlestick pattern is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend. This pattern reverses the downtrend to the uptrend. It consists of three candlesticks: a big red candle, a small doji, and a big green candle. With a high winning ratio, this pattern can be effectively utilized in trading.

Morning Star Candle Stick Pattern

The morning star forex pattern is made up of three candlesticks. It starts off with a large red bearish candle, followed by a small bullish or bearish candle (or a doji candlestick ), and then completes with a large green candlestick. To be considered a valid morning star forex pattern, most traders want to see the third green candlestick close.

Morning Star Candlestick Pattern definition and guide

The morning star candlestick pattern is a three-candlestick reversal pattern that indicates bullish signs to technical analysts. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick.