VAT invoice requirements Tide Business

VAT identification number A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

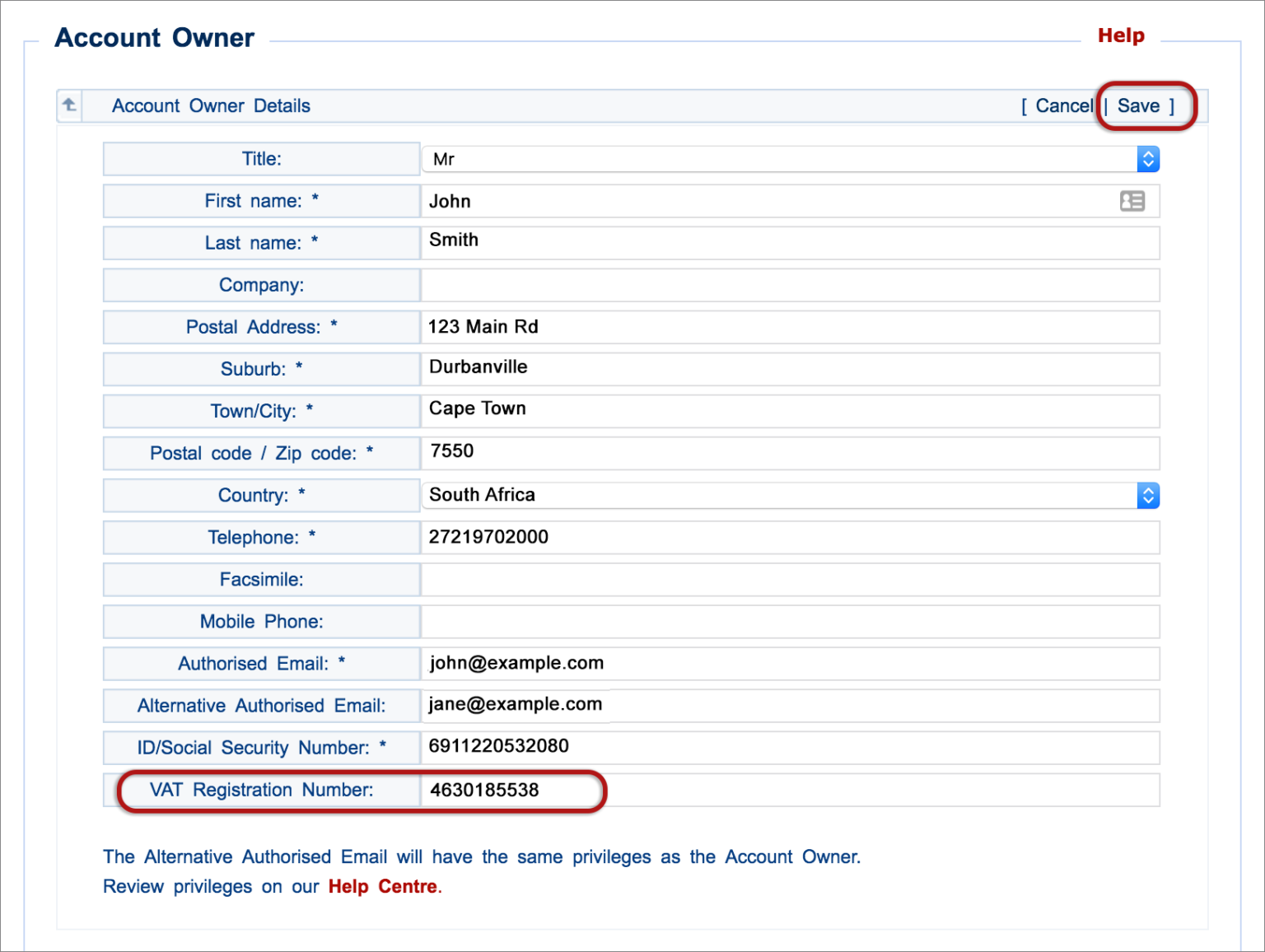

Include VAT Number In Invoices

The VAT identification number is a series of numbers and letters that is different for every entrepreneur. A Dutch VAT number starts with NL, then comes 9 digits, the letter B, and then another 2 digits. Example: NL123456789B01. Your VAT number shows customers and suppliers that you are a VAT-registered entrepreneur.

What is the VAT Number? iContainers

VAT number 2023: Format, Registration, Threshold & more. E-commerce trade is becoming increasingly popular compared to traditional trade and brings one or two advantages with it. One would be, for example, the possibility of being able to trade across national borders. The prerequisite for intra-European trade is a VAT number, which identifies.

How to Find a Business’s VAT Number? CruseBurke

What Is the Valid EU VAT Number Example? A valid example of an EU VAT number is one with 11 characters, where the first or second characters are alphabetical. It ends with a MOD11 checksum digit. For example, DE123456789. What Is the Difference Between the VAT Number and the EU VAT Number?

Handling VAT Identification No. and Group VAT ID AppVision Kft.

Also known as a Tax Identification Number (TIN), a Tax Number is a unique identifier issued to taxpayers engaging in taxable activities in a specific country. This number, which can be a combination of letters and numbers, serves as a signal that the taxpayer is officially registered with the relevant tax authority.

VAT Number and VAT Registration Euro VAT Refund

2022 - Learn about sales taxes within North America. Find out which goods or services are liable to sales tax when you should register and how to pay sales taxes.

How VAT works and is collected (valueadded tax) WP Coupons

VAT Number Formats. The VAT registration number is the unique number that identifies a taxable person (business) or non-taxable legal entity registered for VAT (Value Added Tax).. Vat n. example: Country code: Characters: VAT in local languages: Australia: 12345678901: AU: 11 characters: ABN (Australian business number) Austria: ATU12345678.

Update my VAT number xneelo Help Centre

VAT number (also called VAT identification number, VAT registration number, VAT ID,. VAT number format, description and example, as well as its local name and abbreviation. Non-EU countries VAT number: List of non-EU countries that have similar rules regarding the VAT number, which are regulated by organizations such as EEA or EFTA.

How to Check and Validate EU VAT Numbers Vatstack

A VAT number is a registered tax identification number in tax systems that use Value-Added Tax (VAT). When you register for VAT in a single country, you receive this identifier for their system.. For example, if you are registered in both France and Germany, you must use the French VAT number for sales to French customers, and the German.

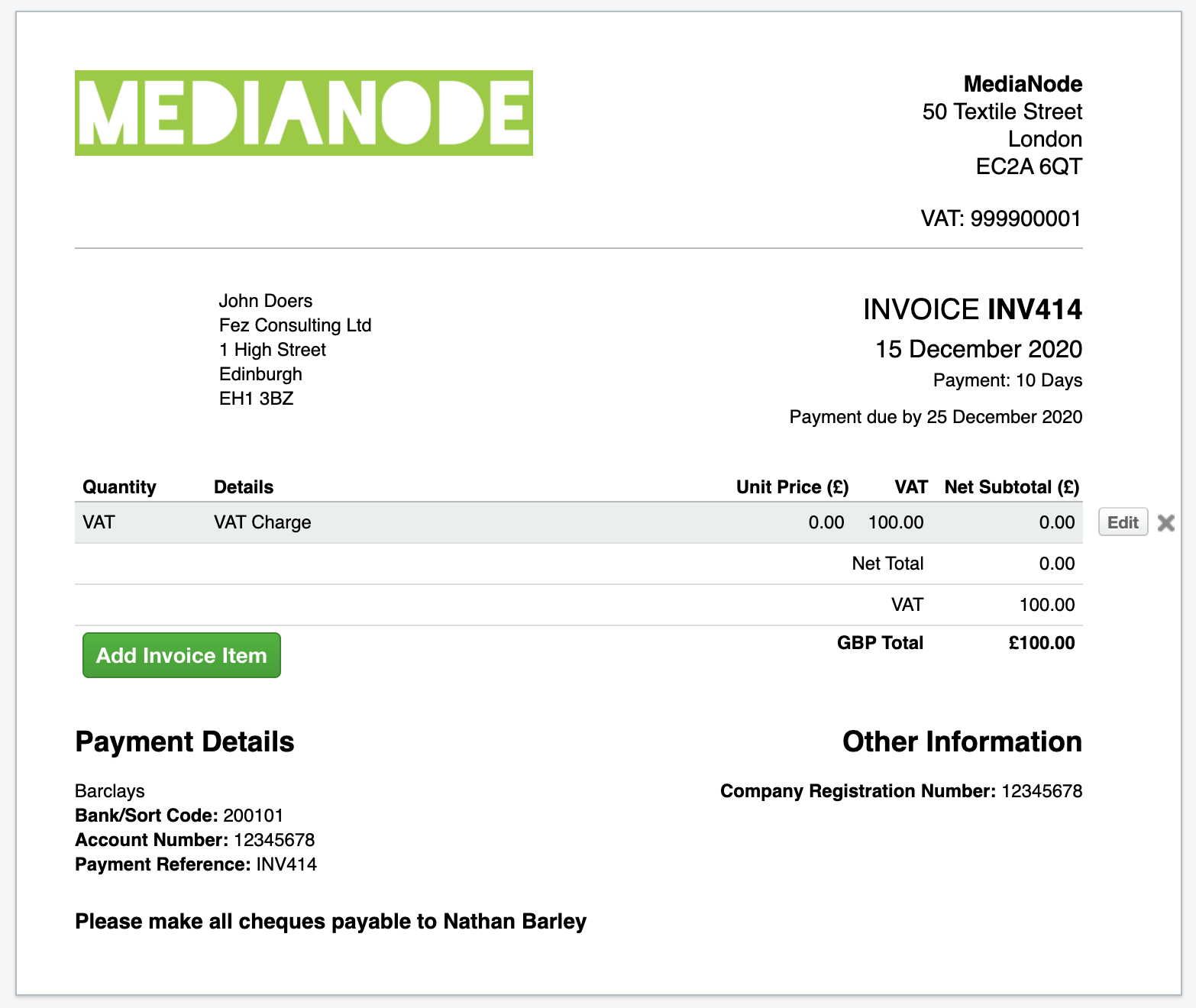

How to create a VAT only invoice FreeAgent

Below is a summary of the standard formats for each EU country, plus: Norway; Switzerland; and UK. EU VAT number formats Click for free EU VAT number formats i nfo Each EU member country has a slightly different format for their VAT number system, featuring a variation of numbers and letters.

The Ultimate Guide to EU VAT for Digital Taxes

Example: VAT numbers for Germany start with the letters "DE" and are followed by 9 digits, such as DE123456789. Example: The VAT country code for Estonia is EE, so an Estonian business's VAT number may look like EE93810511 The letters at the start of a VAT number may change based on the language you're using.

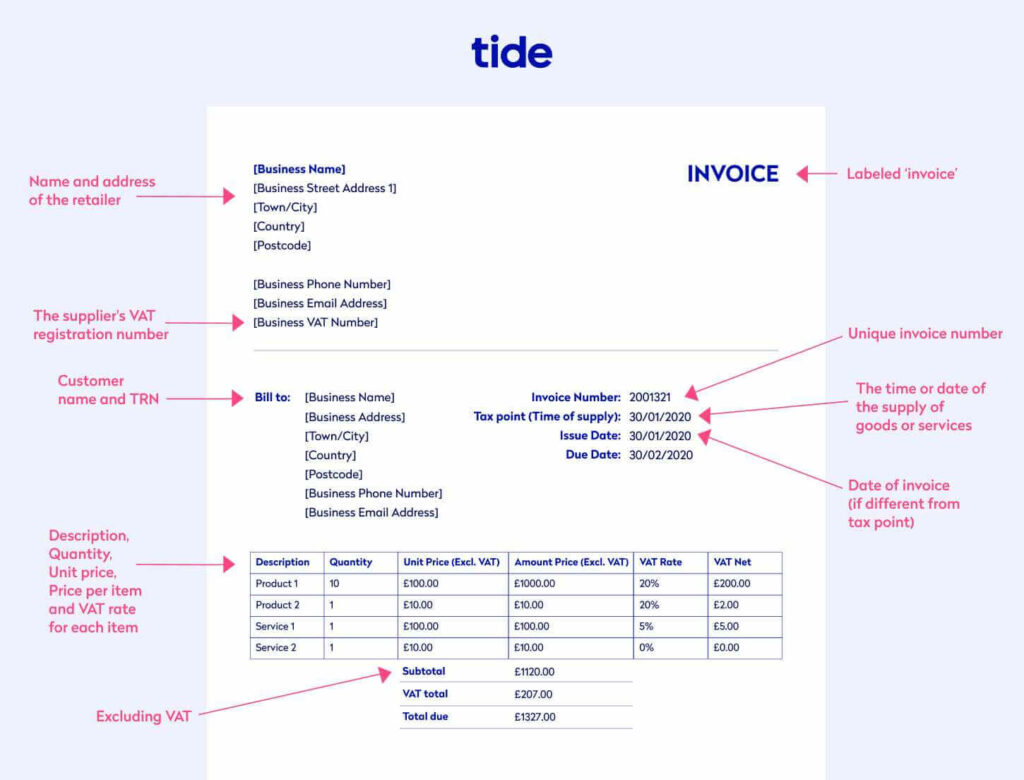

Free VAT Invoice Template Free Download in PDF Bonsai

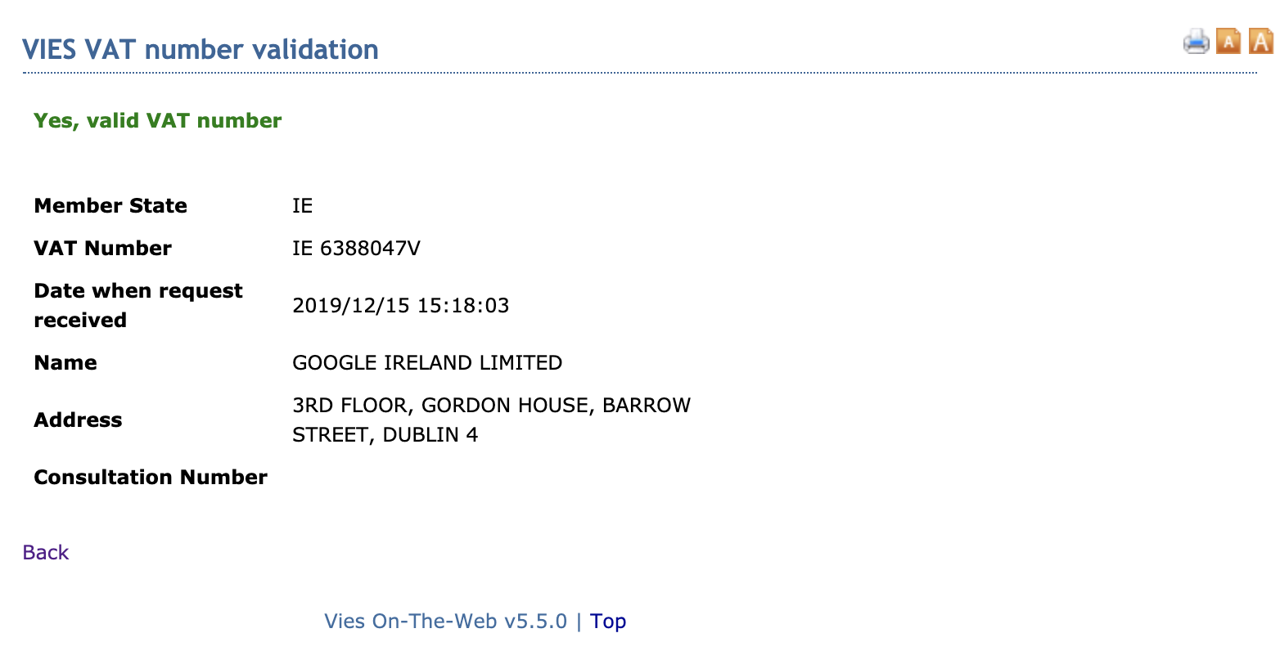

What is VIES? VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool. The search result that is displayed within the VIES tool can be in one of two ways; EU VAT information exists ( valid) or it doesn.

How to Calculate VAT of UK in Tally 9 and its Accounting Treatment Accounting Education

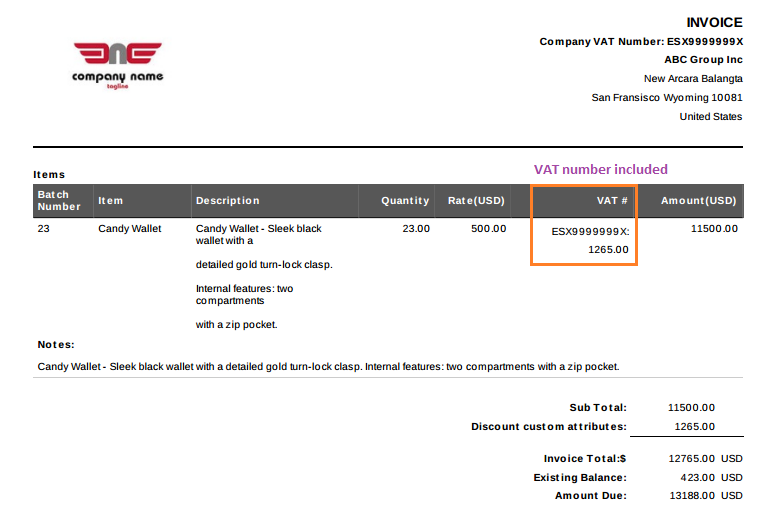

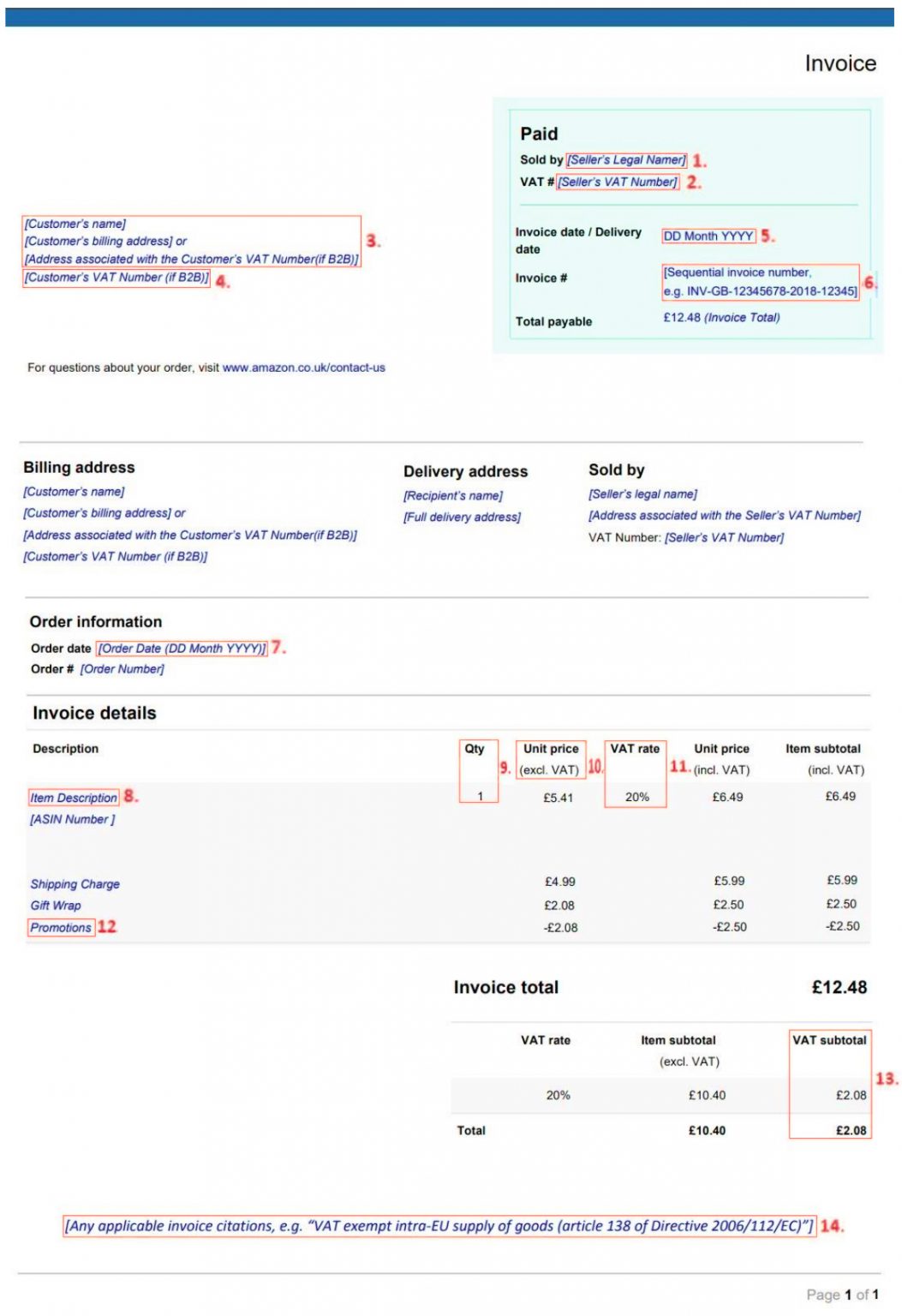

A VAT invoice is an invoice that a business issues to a client for goods and services subject to VAT. A properly documented VAT invoice includes all of the elements of a regular invoice, along with the VAT identification number and VAT amount charged per product.

How VAT works and is collected (valueadded tax) Perfmatters

As soon as your annual turnover of sales from one EU country (let's say France) to another one (e.g. Germany) exceeded this limit, you needed to register for VAT in the country of import (in this case Germany). The VAT threshold was set differently in each country, in Germany for example at 100,000 EUR.

A ValueAdded Tax (VAT) Invoice GeekSeller Support

Validation You're responsible for the accuracy of customer information including their tax ID number. The invoice includes the customer tax ID whether or not it's valid. Stripe provides automatic validation to help determine if the formatting is correct when you add the ID to our system.

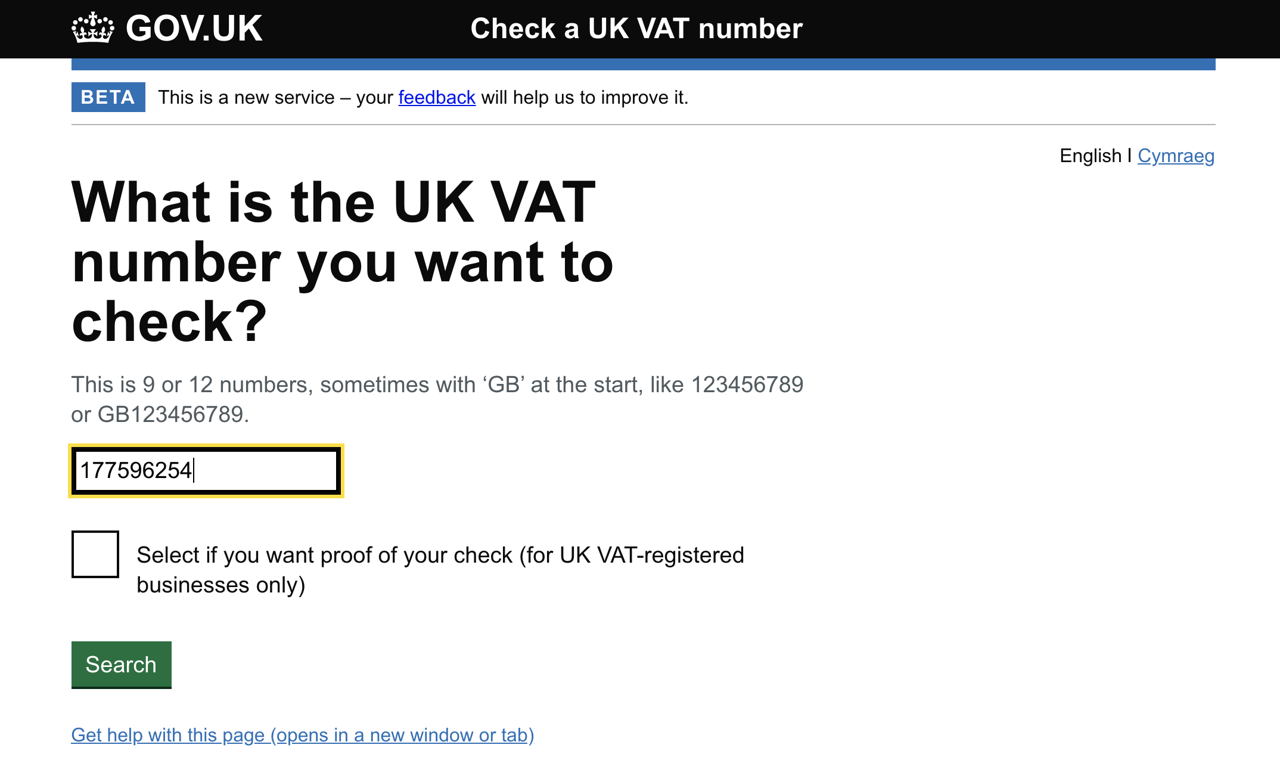

UK VAT Number Validation Vatstack

VAT Use these EU country codes, VAT numbers and foreign language letters to complete an EC Sales List (ESL).